When you are involved in a car accident, it is important to understand who is…

Hundreds of car accidents take place in Georgia each day, which means thousands of Peach State residents pay auto insurance deductibles every year. Some auto insurance policies have no deductibles, but most of them require policyholders to pay between a deductible amount of $100 and $1,000 whenever a claim is filed. This may seem a bit unfair when the deductible is high and the accident was somebody else’s fault. However, insurance companies do not consider fault or blame when they collect deductibles.

Do you have to pay your deductible if you're not at fault? Nathan Fitzpatrick is a skilled and experienced car accident attorney who has litigated hundreds of car accident cases for his clients in Georgia. In this article, he explores what auto insurance deductibles are, how they lower your monthly premiums, and why you may have to pay one after an accident even if you were not at fault. He will also cover some strategies that you could use to recover accident expenses, such as auto insurance deductibles from negligent drivers.

Understanding Car Insurance Deductibles

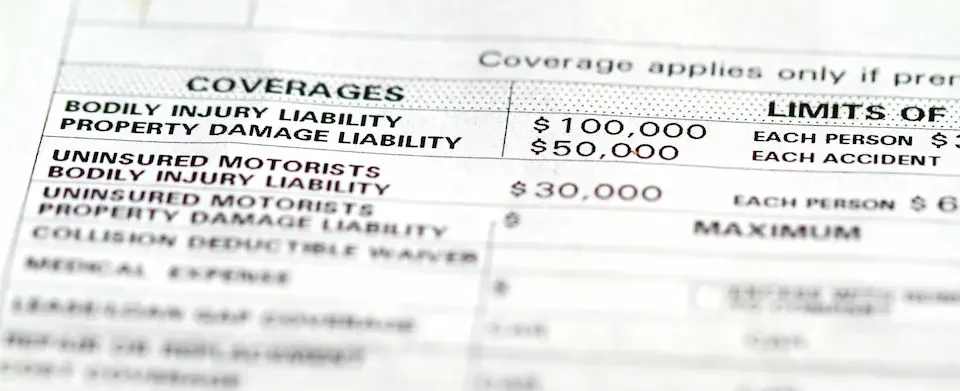

An auto policy deductible amount is a sum that an insurance company deducts from the amount they pay to settle a claim. Most auto insurance policies have a collision deductible and a comprehensive deductible, but some have separate deductibles for liability, personal injury, and broken glass claims. Policyholders can usually choose how large or small they want their deductibles to be. Insurance companies charge lower premiums when deductibles are high because they know that settling claims will cost them less.

High deductibles also save insurance companies time and money. Your own insurance company probably uses this method. As an example: A motorist with a $1,000 deductible amount is not going to submit a claim to repair a broken window, but a policyholder with a zero or $100 insurance deductible amount probably would. Insurance companies collect deductibles every time they settle a claim, so they don’t care who was at fault. You would not be at fault if your car was stolen from a secure facility, but you would still pay a deductible if you filed an insurance claim.

The Difference Between Car Insurance Deductibles and Premiums

Your auto policy premiums are the amounts you pay to your insurance company to cover your car. Your auto deductible is the amount that your insurance company deducts from the amount it sends you when it settles a policy claim. You won’t have to write a check or pull out a debit or credit card to pay an auto policy deductible because the amount will have already been deducted from the funds you receive. You must pay car insurance premiums every year in Georgia even if you are a safe driver, but you only pay a car insurance deductible if you submit a claim following an accident, theft, or break-in.

The Purpose of Car Insurance Deductible

Insurance companies collect deductibles, including car insurance deductibles, for many reasons. Deductibles reduce the number of claims they have to deal with because it makes no sense for policyholders to submit claims that are worth less than or about the same amount as their deductibles. Offering deductibles on auto policies of $1,000 or even $2,000 allows insurance companies to avoid most minor claims and offer extremely attractive premiums. Switching from a $100 deductible to a $2,000 deductible reduces the cost of a six-month Progressive collision policy from $420 to $135, which is a premium reduction of 68%.

Evaluating Fault in a Georgia Car Accident Claim

When it comes to car insurance, Georgia is an at-fault state. That means the paperwork completed by police officers at car accident scenes must state which driver caused the accident in the police report. In most cases, the responding officer leaves little room for doubt by issuing the at-fault driver a ticket for speeding, reckless driving, or some other motor vehicle infraction. However, things become more difficult for first responders when two or more drivers appear to be at fault. In these situations, officers include as much information as they can in their reports and may ticket more than one motorist. The final allocation of blame is then left to the insurance companies involved or a court.

The Not-at-Fault Scenario in Georgia

If you are involved in a car accident in Georgia that is caused by somebody else, you will still have to pay your auto policy deductible if you file a claim with your own insurance company. Georgia requires all motorists to carry at least $25,000 in bodily injury and property damage coverage, so you should also be able to file a claim with the negligent driver’s auto insurance provider. You won’t have to pay a deductible if you file a claim with the other driver’s insurance company, but the process will take longer, and you will have to fight harder to get paid. If you do not have comprehensive coverage, you will have to file a claim with the other driver's insurance company, as your liability protection only covers the injury, loss, or damage that you cause to others.

What if There Was an Injury in the Crash? Does That Affect the Deductible?

You will have to pay your auto policy deductible if you file a claim with your insurance company after a crash, even if nobody was hurt. If you suffer injuries in an accident that prevent you from working for some time, the amount you receive from your insurance company may not be sufficient to cover your medical bills and lost income. The negligent driver would still be responsible, but you would have to submit a claim with their insurance company or file a lawsuit to receive proper compensation. If the negligent driver had only the minimum coverage required by law, personal injury litigation would likely be your best option.

Car Accident and the Role of the Insurance Company

Whether you file a claim with your insurance company or another driver’s insurance company after a car accident, the policy adjuster you deal with will be trained to settle your claim for as little as possible. These people work for their employers and not policyholders, and they follow strict guidelines when they evaluate claims. Your auto policy may provide $50,000, $100,000, or even $1 million of comprehensive coverage, but that does not mean your insurance company will be happy to pay these amounts. Discussions to settle car accident claims can drag on for hours or even days, and people who are not strong negotiators tend to walk away from the table with less.

Advantages of Filing a Claim with Your Insurance Company

Filing a claim with your insurance company after a crash will probably save you some time, and you are likely to be treated courteously and professionally. Your insurance company will still try to settle your claim for as little as possible, but it will be equally interested in keeping you as a customer. On the other hand, your premiums could increase, and you will have to pay a deductible if you file a claim with your insurance company.

Coverage for Not-at-Fault Accidents

You should be able to pursue compensation following a not-at-fault accident in Georgia because state law requires all drivers to carry liability and bodily injury coverage. If your auto policy includes comprehensive coverage, you could choose to file a claim with your insurance company instead. You must remember that the policy’s limits will cap the amount you receive, so you may have to file a lawsuit to receive adequate compensation if you suffered a severe injury, loss, or damage.

Exceptions to Paying Your Deductible

Your insurance company will collect a deductible every time you submit a claim, regardless of the circumstances and who was to blame. You will pay a deductible if your car is stolen or catches fire, and you will also pay one if you submit a claim following an at-fault or not-at-fault accident. If you had an accident and did not pay an insurance deductible, it was because you:

- Filed a claim with another driver’s insurance company

- Chose not to file a claim because your vehicle sustained only minor damage

- Have an auto policy with a zero deductible

What Does Liability Insurance Pay For?

Liability, in the legal sense, means responsibility for one’s actions. We control vehicles capable of causing a great deal of destruction every time we get behind the wheel, so we are expected to act responsibly and do all that we can to avoid accidents. If we fail to meet this duty of care, we are liable for the injury, loss, or damage we cause. This is what liability insurance covers drivers against. When drivers act negligently and cause accidents, their liability coverage pays the motorists, who were not responsible for the crash, vehicle repairs, and medical bills.

Essential Steps for Financial Recovery After a Motor Vehicle Accident

In the aftermath of a motor vehicle accident, it's vital to prioritize your well-being and ensure that your rights are protected. Here's what you need to do:

- Document Medical Expenses: After the accident, it's best to get medical treatment to safeguard your health. Not only that, it's also crucial to diligently record and maintain all associated costs. This includes not just the immediate expenses but any subsequent treatments or therapies you might undergo.

- Use Your Own Insurance First: Initially, file a medical visit under your own insurance policy. This ensures that you receive timely medical attention without waiting for determinations about the at-fault driver.

- Pursue the At-Fault Party: Once you've taken care of your immediate medical needs, it's time to seek compensation from the at-fault party. This is where a comprehensive record of your medical expenses comes in handy. It serves as evidence when negotiating with the other party's insurance.

- Prioritize Your Interests: Remember, insurance companies often aim to minimize payouts. Always act in your best interest. This might mean consulting with professionals who can guide you on the true value of your claim, especially considering potential future medical treatments stemming from the accident.

- Obtain Legal Counsel: If there are complications determining the at-fault party or if you feel that you're not being adequately compensated, consider seeking legal guidance. An attorney can navigate the intricacies of the case, ensuring your best interest is always at the forefront.

- Pay Your Deductible: Understanding the process is essential. If the other driver is uninsured or has insufficient coverage, the initial step is to pay your deductible. Once you pay your deductible, your insurance kicks in to handle the rest. However, before reaching that stage, it's crucial to set aside funds specifically to pay your deductible, ensuring no delays in claim processing. Always remember each time you're in such a situation, the responsibility to pay your deductible comes first. After addressing this primary obligation, your insurance company will manage the subsequent expenses related to the damage.

- Get a copy of the police report: Securing a copy of the police report is imperative. This document will detail the circumstances surrounding the accident, the parties involved, any potential witnesses, and, in many cases, the officer's opinion on who was at fault. While it may not be the final word on liability, it provides an objective account of the incident and can be invaluable when dealing with insurance companies or in court.

- Notify Your Insurance Company: Always inform your insurance company about the accident as soon as possible. Even if you're not at fault, they need to be aware of the incident to provide any necessary support or guidance as you navigate the claims process.

- Document Property Damage: Just as with medical expenses, you should thoroughly document any damage to your vehicle or personal belongings. Obtain repair quotes, take photos of the damage, and maintain a record of any related costs.

- Consult a Personal Injury Lawyer: If the accident resulted in significant injuries or if there's a dispute about who was at fault with the other driver, it's beneficial to consult with a personal injury lawyer. They can provide guidance, negotiate with insurance companies on your behalf, and ensure you receive the compensation you deserve.

- Avoid Discussing the Accident Publicly: Be cautious about discussing the accident on social media or with anyone other than your lawyer, insurance company, or the police. Anything you say can potentially be used against you later.

- Follow Your Medical Treatment Plan: For your well-being and to support any potential injury claims, adhere strictly to the medical treatment plan provided by your healthcare professional. If you fail to follow their advice, it may be argued that you did not take your injuries seriously or that they were not as severe as claimed.

- Stay Organized: Keep all documents, photographs, bills, and correspondence related to the accident in a dedicated folder or digital file. This ensures you have everything you need when making a claim or if you need to go to court.

Seek Legal Advice in Complicated Cases

If you had a car accident, you may be wondering if you should hire an attorney for your car accident claim. In some cases, it can be extremely beneficial. For instance, if you are involved in a car accident and you suffered injuries or more than a few hundred dollars in property damage, it would probably be a good idea to get a free consultation with an experienced legal professional before you accept any insurance company settlement offers. Insurance adjusters work very hard to settle claims for as little as possible, and they deal with these matters on a daily basis. If you want the best outcome possible, you should have an equally experienced negotiator in your corner.

Advantages of Consulting with a Premier Car Accident Attorney

When involved in a car accident, the complexities and challenges that arise can be overwhelming. Engaging a top-tier car accident attorney can present numerous advantages:

- Comprehensive Claims Handling: A skilled car accident attorney does more than represent you. They manage your personal injury claim, ensuring that you receive compensation not only for your immediate injuries but also for all subsequent damages that might arise, some of which you may not initially be aware of.

- Maximized Compensation: By tapping into their extensive knowledge of the law and experience with similar cases, a top-notch attorney can ensure that you receive the full extent of compensation, including additional compensation, that you may not be aware exists. This is crucial because, often, the initial compensation might not cover long-term medical treatments or unforeseen damages.

- Potential Deductible Reimbursement from the Other Insurance Company:

- Understanding Subrogation: Even if you're initially out of pocket due to your deductible, there's a silver lining. Through a legal process called subrogation, your insurance company might recover funds from the driver that is at fault's insurer. Essentially, after covering your initial expenses, your insurer will seek reimbursement from the other party's insurance.

- Recovery of Your Deductible: If your insurance company successfully navigates the subrogation process, you stand a good chance to recover your deductible. With a proficient attorney by your side, you'll be better informed and positioned to benefit from this process. They can also help you with the recovery of expenses that exceed your policy limit.

- Navigating Insurance Complexities: Insurance policies are laden with complex terms and conditions. A reputable car accident attorney can effectively interpret these nuanced terms, ensuring that your interests are always at the forefront. They can guide you on when and how your insurer might pursue subrogation and the implications it has for you.

If You've Been in a Car Accident, Contact The Fitzpatrick Firm, Your Trusted Car Accident Lawyer in Atlanta, GA

Nathan Fitzpatrick is an experienced personal injury attorney who has recovered millions of dollars for car crash victims in Georgia. If you have been hurt in an accident and plan to file an insurance claim, you should have a skilled negotiator like Mr. Fitzpatrick on your side. If you would like to schedule a free case review to discuss what legal options are available, you can call the Fitzpatrick Firm at (678) 607-5550 or fill out our form below.